In recent months, the price of silver has seen a significant uptick, affecting various sectors, notably the jewelry industry. This article delves into how the increased costs of silver have impacted jewelry manufacturers, retailers, and consumers.

RISING COSTS & SUPPLY CHAIN ISSUES

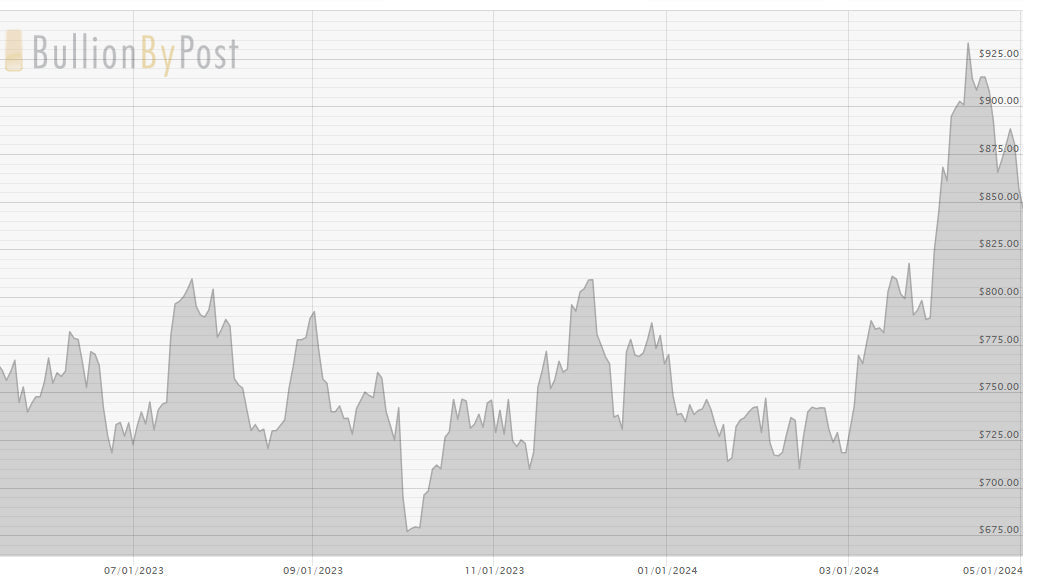

Silver prices have surged by approximately 15% over the past year (2023-2024). As of the last quarter, the price per ounce stands at around $25, marking a notable increase from the previous average of $21.75 per ounce. This price escalation is attributed to a mix of factors including increased industrial demand, investment trends, and geopolitical tensions that have stimulated investors to turn to silver as a safe-haven asset.

- Increased Demand: There's been a notable increase in demand for silver, particularly from industrial sectors such as solar energy and automotive, which use silver extensively. The expansion of solar technologies and the growing use of electronic components in vehicles have significantly boosted the demand for silver.

- Supply Constraints: Silver supply has been under some pressure, with mining outputs unable to keep pace with the rising demand. Notable contributions to silver production have come from new mines in Mexico and increased output in Chile, but these have only partially offset broader constraints.

- Economic and Monetary Factors: The depreciating U.S. dollar and more accommodative monetary policies from central banks have also played a role. A weaker dollar typically makes silver cheaper for holders of other currencies, thereby increasing demand. Additionally, as interest rates are lowered, precious metals like silver become more attractive compared to yield-bearing assets.

- Investment Demand: Beyond industrial use, silver is also a popular investment asset. Investment demand has been driven by market sentiment and the anticipation of long-term price appreciation, influenced by factors like de-dollarization and increased strategic reserves by governments.

- Global Economic Dynamics: Global events and economic policies, such as the response to the COVID-19 pandemic, changes in U.S. monetary policy, and geopolitical tensions, have all influenced commodity markets, including silver.

IMPACT ON JEWELRY MANUFACTURERS

For jewelry manufacturers, the rise in silver prices has translated into higher production costs. Silver, being a primary material for many jewelers and large-scale manufacturers, has seen its cost increase from 12% to 17% over the past year. However, silver jewelry still remains a popular choice for its quality and value.

RETAIL AND CONSUMER EFFECTS

On the retail front, the increase in silver prices has led to higher retail prices for silver jewelry. Retailers report an average price increase of around 10% across various silver products. This price adjustment is often passed onto consumers. Data from consumer surveys indicates a 5% decline in silver jewelry purchases since the price hike, highlighting a price sensitivity among buyers.

STRATEGIC RESPONSES IN THE INDUSTRY

In response to these challenges, the industry is seeing a strategic shift. Some jewelers are enhancing their marketing efforts towards promoting the intrinsic value and timeless appeal of silver, aiming to justify the higher price points.

Experts suggest that silver prices may stabilize but are unlikely to return to previous lows in the near future. This forecast is based on sustained industrial demand, particularly from sectors like solar energy, which heavily relies on silver. Consequently, the jewelry industry may need to adapt to a new normal where silver remains a more expensive resource.

The recent increase in silver prices presents both challenges and opportunities within the jewelry industry. While the immediate impacts include higher production and retail costs, leading to reduced consumer purchases, there is potential for creative adaptation. By adjusting product lines and reinvigorating marketing strategies, the industry can navigate these times and possibly emerge more resilient and innovative. Overall, sterling silver jewelry is here to stay and will be a popular choice for its intrinsic value and timeless appeal.

![Gold Filled Beaded Ring, Gold Silver Stacking Ring, Hammered Bead Ring, Gold Dot Ring Midi Ring Gold Filled Flat Beaded Ring Minimalist [30] - HarperCrown](http://www.harpercrown.com/cdn/shop/products/gold-filled-beaded-ring-gold-silver-stacking-ring-hammered-bead-ring-gold-dot-ring-midi-ring-gold-filled-flat-beaded-ring-minimalist-30-568879.jpg?v=1634159908&width=2048)

![Gold Filled Beaded Ring, Gold Silver Stacking Ring, Hammered Bead Ring, Gold Dot Ring Midi Ring Gold Filled Flat Beaded Ring Minimalist [30] - HarperCrown](http://www.harpercrown.com/cdn/shop/products/gold-filled-beaded-ring-gold-silver-stacking-ring-hammered-bead-ring-gold-dot-ring-midi-ring-gold-filled-flat-beaded-ring-minimalist-30-638411.jpg?v=1634159908&width=2048)